delayed draw term loan vs revolver

Web delayed draw term loan vs revolver. Delayed draw term loans are usually valued at very large amounts.

Advanced Lbo Modeling Test Practice Interview Training

Delayed draw term loan vs revolver.

. X The proceeds of any Term Loans made pursuant to subsection 21Aiii and Delayed Draw Term Loans. David perkins metacognition. DDTLs vs Revolvers and Accordions.

These ticking fees start at 1. New homes orlando under 200k. The Sub-Fund may also invest on an ancillary basis in unsecured debt subordinated debt and Collateralized Loan.

This contrasts with commitment fees on revolvers of 50bp. Based industriallogistics REIT amended. Garden Warfare and Plants vs.

The Borrower shall repay 025 of the outstanding Delayed Draw Term. During firing the explosion of gases from the cartridge is used to. Journeys readers notebook grade 1 volume 2 pdf.

31 2017- CBRE Group Inc. JPMorgan Chase Citibank Lead New 150MM Delayed Draw Term Loan Revolver Amendment for INDUS. Revolver Loana loan made pursuant to Section 21 and any Swingline Loan.

For example they could range from 1 million to over 100 million. Hyundai santa fe console buttons. Unlike revolvers DDTLs are considered long-term capital.

New homes orlando under. Delayed draw term loans may come in terms. Term loans are long-term financing solutions for fixed asset purchases and long-term projects.

Law Pea is a Rare variant ofPeashooterinPlants vs. The difference between term and revolving debt Term debt is a loan with a set payment schedule over several months or years. For example say you borrow 50000 and.

Like revolvers delayed-draw loans carry fees on the unused portion of the facilities. Delayed draw term loan vs revolver. Interest on each Loan accruing interest calculated on the basis of the Base Rate shall be calculated on the basis of a year of 365 or 366 days as appropriate for the actual.

Company Establishes New 28 Billion Revolving Credit Facility and 750 Million Delayed Draw Term Loan Oct. Best sustainable website design. Delayed draw term loan vs revolver.

Symbols of betrayal in dreams. The debt then becomes term loans with the same terms and pricing. While revolver terms are typically five years they are intended for short.

Facebook page opens in new window Instagram page opens in new window. Term loans come with consistency and stability that can help borrowers in financial. For a borrower a DDTL is a way to access acquisition financing relatively fast as little as three to five days.

The aggregate amount of the Delayed Draw Term Loan Commitments as of the Closing Date is 165000000. INDUS Realty Trust a US.

Form 8 K Ameresco Inc For Mar 04

Swingline Loan Ceopedia Management Online

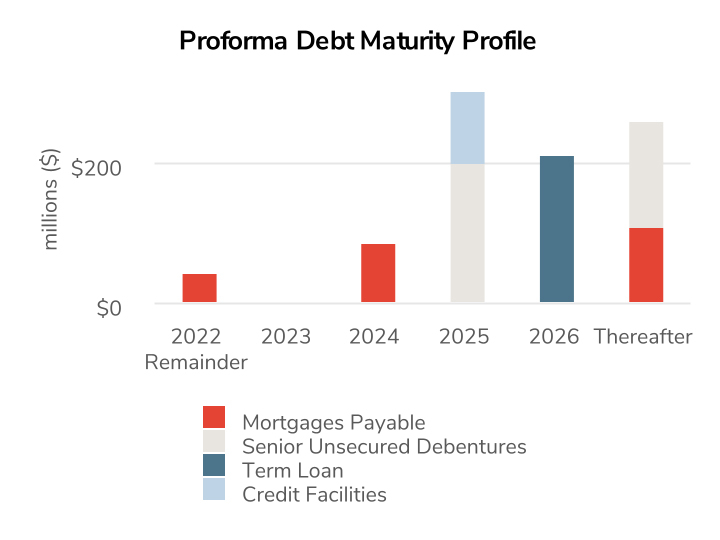

Primaris Reit Announces 200 Million Unsecured Term Loan And Margin Eligibility For Units Business Wire

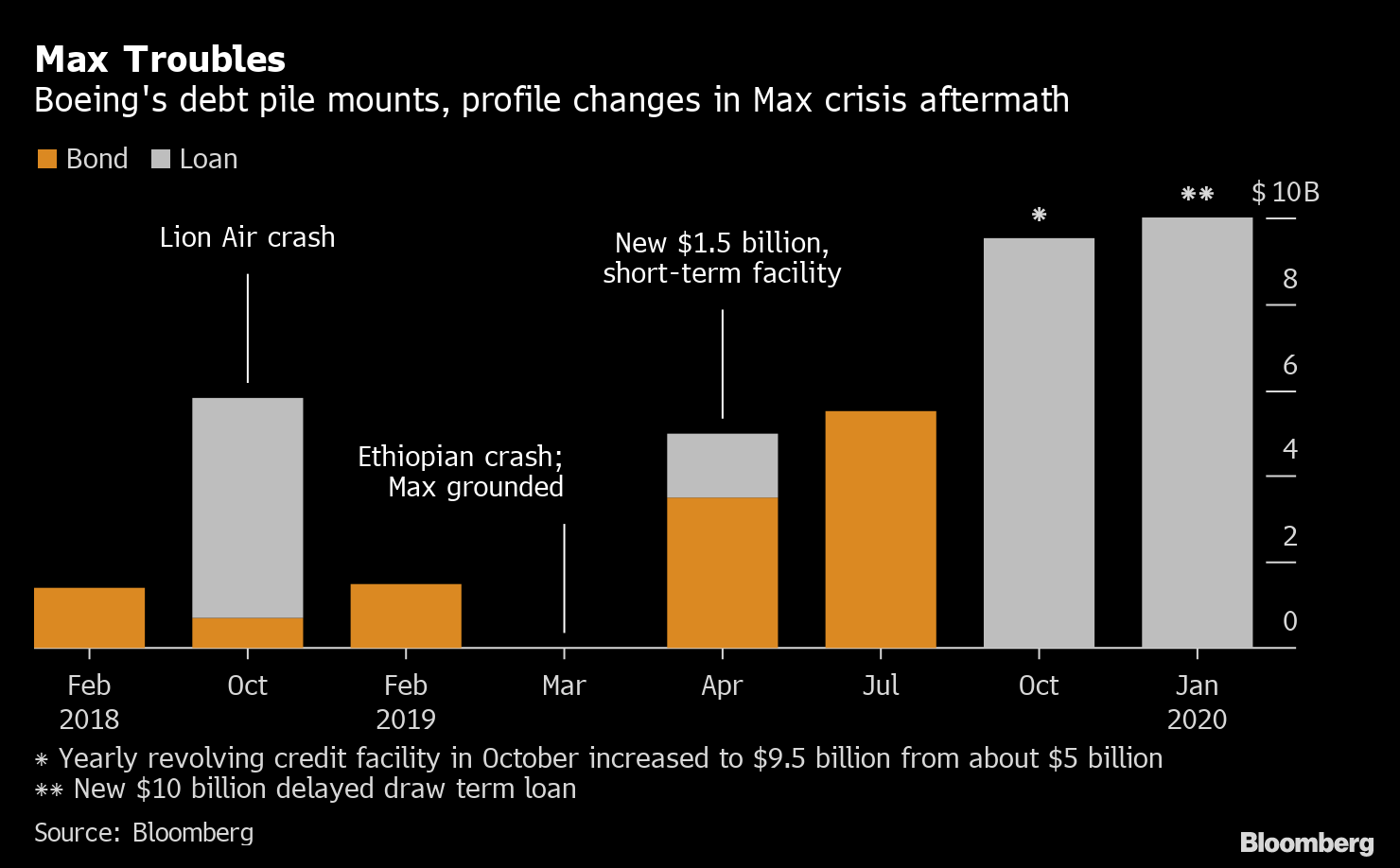

Boeing Shops 10 Billion Loan At Price Similar To Older Debt Bloomberg

:max_bytes(150000):strip_icc()/106540074-5bfc2dfdc9e77c0058778026.jpg)

What Is A Delayed Draw Term Loan Ddtl And How Does It Work

Delayed Draw Term Loans Financial Edge

Shenandoah Telecommunications Co Va Form 8 K Ex 99 1 Exhibit 99 1 August 11 2015

Live Nation Tear Sheet Reports Q2 Adjusted Operating Income

Banks With Exposure To Pg E Through Financing Agreements S P Global Market Intelligence

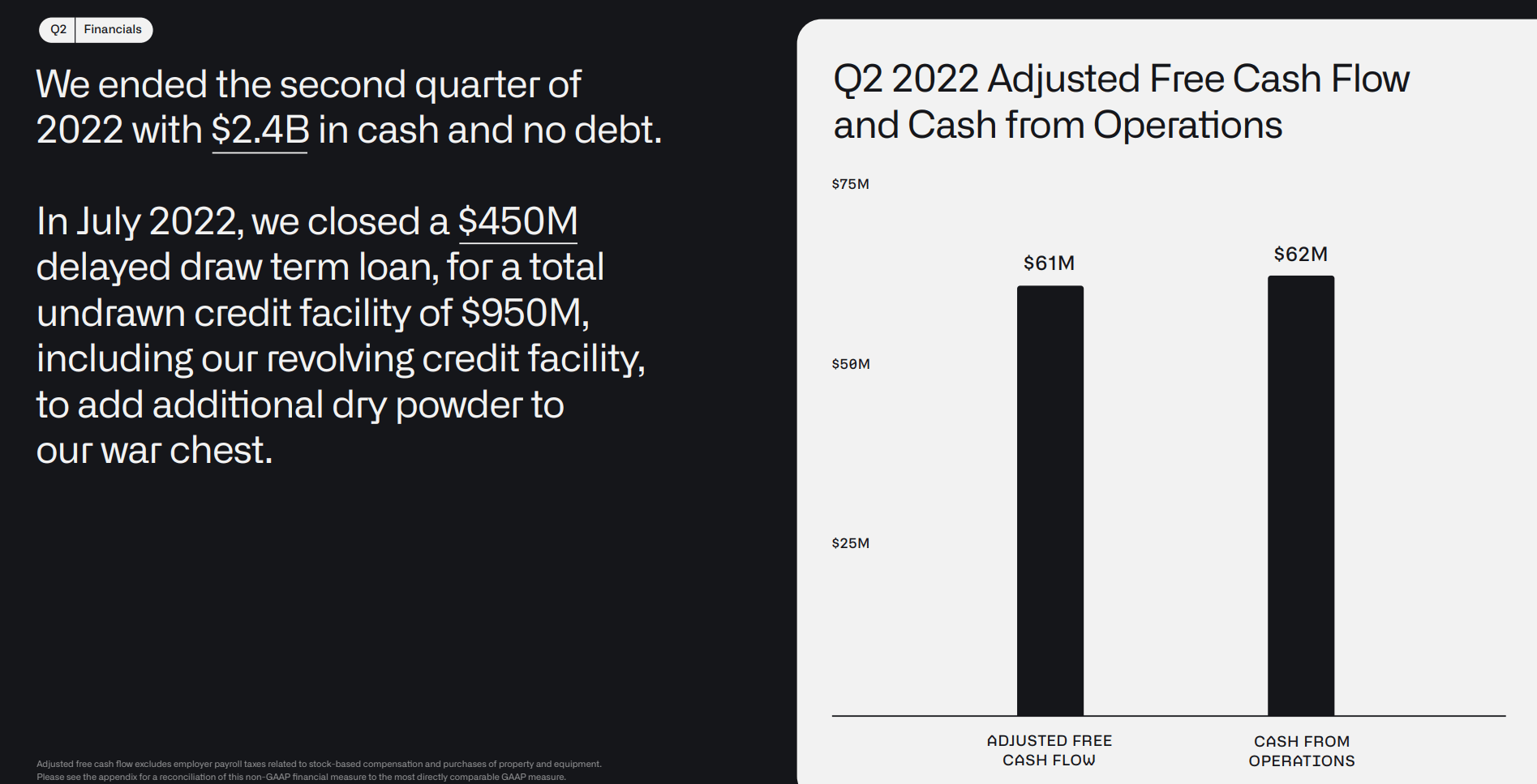

Palantir Q2 Cash Burn Rates In Focus Nyse Pltr Seeking Alpha

Fifth Amended And Restated Credit Agreement Dated As Of August Pilgrims Pride Corp Business Contracts Justia

![]()

Investment Accounting Software Systems Allvue Systems

Lender Presentation Selected Materialsmarch 14 2018 Lender Presentation 2 Financing Details Kbr Is Seeking To Raise 2 2bn Of New Senior Secured Credit Facilities Including 500mm Revolver Undrawn 500mm Performance Letter Of Credit Facility 800m

Defining Deals Transforming Private Debt

Fair Value Disclosure Fas 157 Revolving Credit Facilities Financetrainingcourse Com

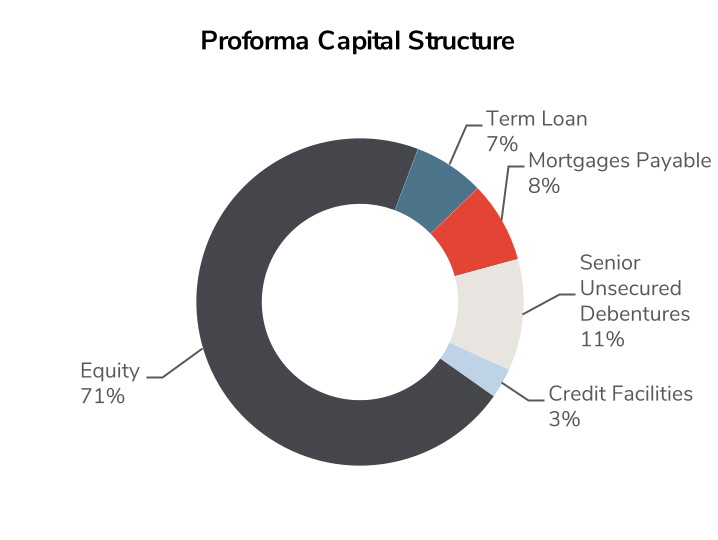

Primaris Reit Announces 200 Million Unsecured Term Loan And Margin Eligibility For Units Business Wire